Old Age Security (OAS)

More Resources

- GST/HST

- Canada Childcare Benefit (CCB)

- Old Age Security (OAS)

- Ontario Disability Support Program (ODSP)

- Canada Pension Plan (CPP)

- Ontario Works

- Assured Income for the Severely Handicapped (AISH)

Table of Contents

The Government of Canada has many programs available to help older adults bolster their retirement income; the Old Age Security (OAS) program is one of them. This multiplan program provides financial assistance to Canadian residents and citizens 60 years of age or older with its four benefits — Old Age Security Pension, the Guaranteed Income Supplement, the Allowance, and the Allowance for the Survivor.

This article will cover the Old Age Security program — what each benefit plan entails, who is eligible, how to apply, the payment amounts, schedule, and more.

| January 27, 2022 | February 24, 2022 | March 29, 2022 |

| April 27, 2022 | May 27, 2022 | June 28, 2022 |

| July 27, 2022 | August 29, 2022 | September 27, 2022 |

| October 27, 2022 | November 28, 2022 | December 21, 2022 |

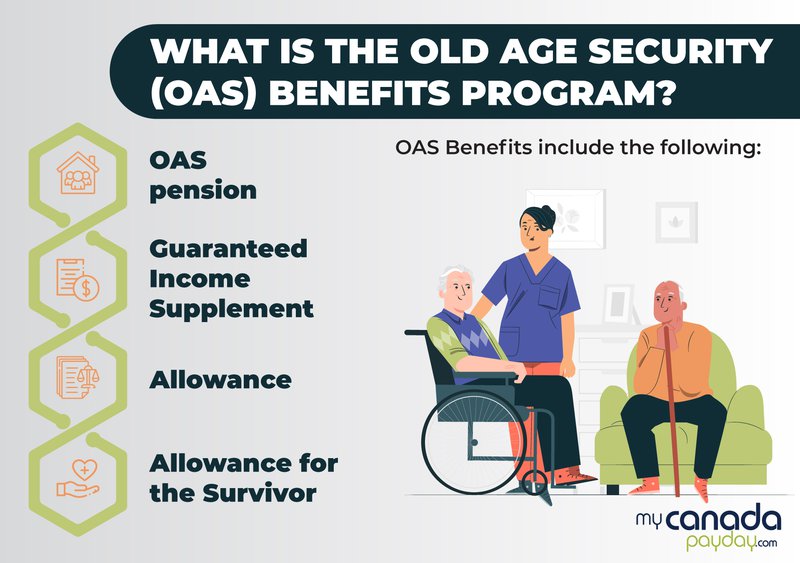

What is the Old Age Security (OAS) Benefits Program?

The OAS program combines several benefits that provide monthly payments to older adults and senior citizens. The Government of Canada funds the OAS; this means you do not have to contribute to OAS through employment to receive its benefits.

The OAS program is an umbrella of the following four benefits:

- OAS pension: A taxable monthly payment for Canadian legal residents and citizens 65 years of age or older.

- Guaranteed Income Supplement: A non-taxable monthly payment for low-income OAS pension recipients.

- Allowance: A monthly payment for low-income individuals aged 60 to 64 whose spouse or common-law partner is a Guaranteed Income Supplement recipient.

- Allowance for the Survivor: A monthly payment for those aged 60 to 64 whose spouse or common-law partner has died.

OAS is a fundamental component of Canada’s retirement system. Its purpose is to help Canadians secure a modest monthly payment that covers their basic living expenses during retirement, especially when no other income sources are available.

OAS Pension

Old Age Security Pension is an automatic monthly payment accessible to those 65 or older. You will have to pay monthly or quarterly income tax on the payment.

You can voluntarily defer your OAS pension up to five years to receive a larger payment. The pension amount increases by 0.6 percent for each month (7.2 percent annually) you delay receiving the benefit upon turning 65. If you defer the payment for five years, your pension will increase by 36 percent.

Eligibility

Any Canadian citizen or legal resident can receive an OAS pension, regardless of their employment history and whether or not they’re currently living in Canada.

You can qualify for either full pension or partial pension, depending on how long you’ve lived in Canada since turning 18.

To be eligible for a full pension, you must have lived in Canada for at least 40 years once you turned 18. But, you can qualify for a full pension without residing in Canada for four decades in some situations. For example, if you were over 25 years of age and were a Canadian immigration visa holder before July 1, 1977, you will be able to waive this requirement.

Those who do not meet the residency requirement for a full pension may still be eligible for a partial pension if you meet the following requirements. You must:

- Be a Canadian resident or citizen while the Government of Canada is approving your OAS pension application

- Have lived in Canada for at least ten years after turning 18.

If you’re not currently living in Canada, to qualify for partial OAS pension you must:

- Be 65 years of age or older

- Have been a Canadian citizen or legal resident on the day before you left Canada

- Have lived in Canada for at least 20 years since turning 18.

If you’re a Canadian working for a Canadian employer in another country, your time outside of Canada can be qualified as a residency in Canada. For this, you must have either:

- Returned to Canada within six months of your employment ending.

- Turned 65 years of age or older while you were still employed and maintained a residence in Canada during your stay abroad.

You also need to provide these two documents:

- Proof of employment from your employer

- Proof of returning to Canada (except if you turned 65 years old while working abroad)

OAS Pension Application Process

In most cases, Service Canada will automatically enroll you for OAS pension. The month after you turn 64 years old, you will receive one of the following letters from Service Canada:

- A notification letting you know that you were automatically enrolled for an OAS pension.

- An OAS eligibility notification letter that may include an application.

If you receive the second letter or haven’t received any correspondence from Service Canada, you can submit your application via mail or online up to 11 months before turning 65.

Apply Online

You can submit an online application through your My Service Canada Account (MSCA) starting one month after turning 64. You must also be living inside Canada and not have another person acting by proxy through your account.

Make sure to have the following documents ready before starting the application process. This is important since your session is pre-set to expire after 20 minutes of inactivity.

- Your SIN

- Your spouse or common-law partner’s SIN and date of birth

- Your residence details after you turned 18

- Your banking information to set up direct deposit

- When you’d like to start receiving pension

- Your reduction in pension income or employment, if relevant

Apply by Mail

To apply by mail, fill out the form ISO-3550 Application for the Old Age Security Pension. Make sure to include certified copies of all the requested documents.

Then, submit the completed form in person or mail it to your nearest Service Canada office.

After applying, you will receive a letter notifying you whether you are qualified for OAS pension or if Service Canada needs more information. You can view your application status through your MSCA account too.

If your application is denied, you can request a review within 90 days of receiving the decision letter.

Payment Amount

From January to March 2022, full OAS pension recipients whose income is under $133,141 can collect the maximum monthly benefit amount of $642.25. Service of Canada reviews the OAS pension amount every January, July, and October to accommodate the increase in the cost of living.

If you’re 75 years of age or older, your pension will automatically increase by 10 percent as of July, 2022.

Those eligible for partial OAS pension will receive 1/40th of the full pension amount for every year you’ve resided in Canada since turning 18. If you’ve lived in Canada for 30 years upon turning 18, you may receive 75 percent of the full OAS pension.

Guaranteed Income Supplement (GIS)

GIS is a tax-free monthly payment that provides additional financial assistance to low-income seniors who are receiving OAS Pension.

GIS Eligibility

Here is the eligibility requirements for GIS payments:

- You must be 65 years or older.

- You must be an OAS pension recipient.

- You must live in Canada.

- Your annual income must be under $19,464 if you’re single, divorced, or widowed. If you have a spouse or a common-law partner, your income combined with your partner’s income should be under:

- $25,728 if your partner receives the full OAS pension

- $46,656 if your partner is not an OAS pension recipient

- $46,656 if your partner gets the Allowance

GIS Application Process

Service Canada will notify you if you’re eligible for GIS. You will have to apply if you’re not automatically enrolled, and if you’re already receiving an OAS pension but have never received a GIS payment.

Apply Online

You can submit the GIS application through your personal My Service Canada Account once one month has passed since your 64th birthday.

Apply by Mail

You can apply for both OAS and GIS together by filling out the ISP-3550 form included with your letter. Or, apply just for GIS by filling out ISP-3025.

Also include the requested certified document with your application. Once everything is ready, send the package to your nearest Service Canada Office.

Service Canada will notify you if your application is approved or denied with a letter. If rejected, you can repeal the decision and request a review within 90 days if receiving the letter.

Payment Amount

The GIS benefit amount you receive will differ based on your marital status, income, and whether your partner receives OAS benefits. You must file your taxes by April 30 every year since Service Canada uses your federal income tax return information to update your payment annually.

The following amount is applicable from January to March 2022.

| Situation | Total household income | Maximum Benefit |

|---|---|---|

| If you’re single, divorced or widowed | Under $19,464 | $959.26 |

| If your spouse or common-law partner is a full OAS pension recipient | Under $25,728 | $577.43 |

| If your spouse or common-law partner is not an OAS pension recipient | Under $46,656 | $959.26 |

| If your spouse or common-law partner receives the Allowance benefit | Under $35,616 | $577.43 |

The Allowance

Allowance refers to a tax-free monthly payment provided to older adults between ages 60 to 64.

Eligibility:

To qualify for the allowance, you must meet the following criteria:

- Be between ages 60 and 64

- Be a Canadian citizen or legal resident

- Your spouse or common-law partner must be an OAS pension recipient or be eligible to receive GIS

- You must have lived in Canada for at least ten years after turning 18

- You and your partner’s combined income should be less than $36,048

Allowance Application Process

Service Canada gives applicants the flexibility to apply through online or by mail.

Apply Online

You can apply for Allowance online through your personal My Service Canada Account. But make sure to have the required documents ready since your session will end if you’re inactive for 20 minutes.

Apply by Mail

Download, print, and fill out the form ISP3008 and ISP 3026. Include certified copies of all the necessary documents.

Once your application package is ready, mail or physically hand it to your nearest Service Canada office.

Service Canada will notify you if you’re approved or denied for Allowance in writing. If denied, you can appeal the decision within 90 days of receiving the letter.

Payment Amount

How much Allowance benefit you receive will depend on the combined income of you and your spouse or common-law partner.

The following Allowance benefit amount is applicable from January to March 2022.

| Income Threshold | Maximum Monthly Payment | |

|---|---|---|

| If your spouse or common-law partner receives full OAS pension and GIS | Under 36,048 | $1,219.68 |

Allowance for the Survivor

An Allowance for the survivor benefit is a non-taxable monthly amount aimed at providing financial assistance to those whose spouse or partner has passed away.

You must be between 60 and 64 years of age to receive an Allowance for the Survivors. It will be replaced with OAS and maybe GIS payment once you turn 65.

Eligibility

The following criteria must be met to be eligible for Allowance for the Survivor payments.

- You must be between ages 60 to 64.

- You must live in Canada.

- Your annual income must be below $26,256.

- You have not remarried or become someone else’s common-law partner since your spouse’s death.

Application Process

You can apply for Allowance for the Survivor after the death of your spouse or common-law partner and 6 to 11 months before your 60th birthday.

You’ll need the following documents and information about you and your spouse/ common-law partner:

- SIN

- Date of birth

- Proof of death of your spouse or common-law partner

- If you were married, you’d need a copy of your marriage certificate

- If you were in a common-law relationship, you’ll need to complete, sign, and submit ISP3104. You will also need to submit proof that you lived together for at least 12 months.

- Foreign income information

- The countries that you have lived since age 18

- Your banking information for a direct deposit

- If your income or pension amount has stopped or reduced, you will need to provide the date when the amount was reduced and what the new amount is

- Your foreign income information

Apply Online

You can apply online for Allowance for the Survivor through the My Service Canada Account. But make sure you have all the info ready since your session will expire due to inactivity for 20 minutes.

Apply by Mail

You’ll need to download, print, and fill out both forms ISP3008 and ISP3026. Also, include copies of the required documents in your application package.

Service Canada will inform you of their decision in writing. If denied, you can ask for a review within 90 days of receiving a response.

Payment Amount

The Allowance for the Survivor benefit payment you receive will depend on your previous year’s income.

The following amount is applicable from January to March 2022.

| Annual Income | Maximum monthly payment | |

|---|---|---|

| If you’re the surviving spouse or common-law partner | Less than $26,256 | $1,453.93 |

When Can You Expect To Hear from Service Canada?

Once you file your application, Service Canada will contact you in writing, informing you of their decision or request additional documents or information to process your application.

If you applied six months or more in advance, Service Canada would ensure that you are paid retroactively for the eligible months (this is capped at 11 months).

If Service Canada requests more information, we recommend that you respond as soon as possible to avoid further delays in receiving payment.

When Will You Receive the Payment?

You will receive your benefit payment through direct deposit on the third to last banking day every month. Otherwise, Service Canada will mail you a cheque within the last three banking days of each month.

If you are already receiving Canada Pension Plan and Service Canada automatically enrolls you for OAS benefit, your payment will automatically be deposited into the same bank account.