Family Benefits in Nova Scotia

More Resources

- Family Benefits in Saskatchewan

- Family Benefits in Canada

- Family Benefits in Manitoba

- Family Benefits in British Columbia

- Family Benefits in Alberta

- Family Benefits in Ontario

- Family Benefits in Nova Scotia

Table of Contents

Popularly known as Atlantic Canada’s commercial hub, Nova Scotia is among Canada’s best provinces to reside in. Not only do you have access to coastal cliffs and sandy beaches, but there is also a lively culture and the hustle and bustle of city life. No matter the time of year, our weather is pleasant, and there is enough to do. Skating and skiing are available during the winter, while golf, hiking, and surfing are available in the summer. There are also theatrical and music events held throughout the year.

Despite Nova Scotia being one of the most affordable provinces in Canada, there are several low-income families, especially since the onset of the COVID-19 pandemic. In fact, the 2022 Report Card on Child and Family Poverty in Nova Scotia shows that 24.6% of children live in low-income circumstances. Luckily, the Government of Nova Scotia has put measures in place to provide support to those in need.

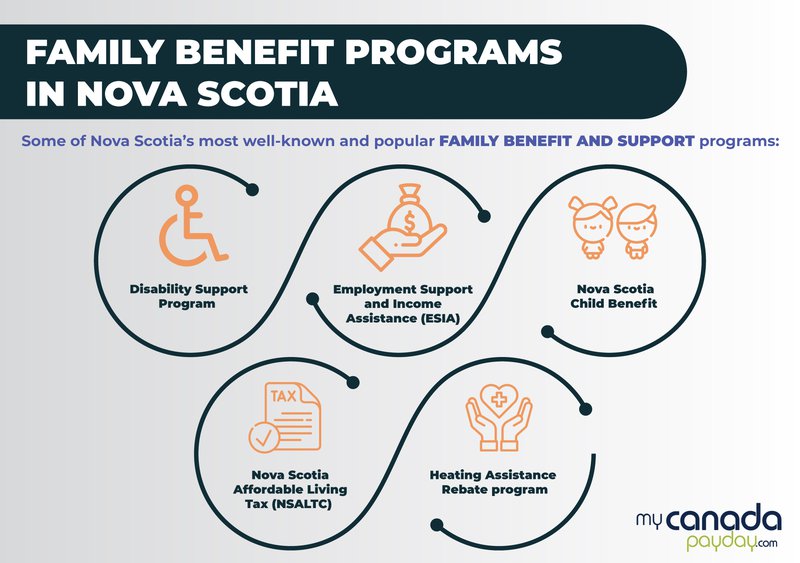

Family Benefit Programs in Nova Scotia

The provincial government of Nova Scotia provides a comprehensive financial aid program for underprivileged persons and groups. Such groups also include families facing financial difficulties, whether they have children or not. Notably, some of these programs are available to families as a whole and individual family members.

Here is a summary of some of Nova Scotia’s most well-known and popular family benefit and support programs:

- Disability Support Program: Provides a variety of residential, community-based, and day/vocational programs for children, teenagers, and adults Novascotia with intellectual impairments, physical disabilities, and long-term mental illness.

- Employment Support and Income Assistance (ESIA): Designed to provide support to families in terms of basic needs, special needs, or employment services

- Nova Scotia Child Benefit: Designed to help low-income households with the expenses associated with raising children under the age of 18 years

- Nova Scotia Affordable Living Tax (NSALTC): Explicitly for low- and moderate-income individuals and families, this credit provides a tax-free amount.

- Heating Assistance Rebate program: Designed to help low-income Nova Scotian households with the costs of home heating

By following the links above, you can discover more about any of these social assistance programs. The section below features a more in-depth look at Nova Scotia’s five most popular family benefit programs.

Disability Support Program

The Disability Support Program consists of various voluntary benefit programs meant to support people with disability at different stages of their independence and development. As mentioned earlier, this social assistance program consists of dozens of vocational/day, community-based, and residential programs that assist individuals with physical disabilities, intellectual impairments, and long-term mental illness. Below is a quick overview of each benefit program and the benefits qualifying applicants can enjoy.

| Type of Benefit | Overview | Benefit |

|---|---|---|

| Standard Household Rate | To cater for expenses related to basic needs, like clothing, shelter, food, personal items, utilities, and fuel | Ranges from $950 - $1,393 depending on the number of family members and their living situation |

| Alternative Family Support (AFS) Program | Designed to assist persons with disabilities living in a private and authorized family homeAlso provides support and monitoring benefits to a maximum of two persons not linked to the AFS provider | Assists eligible applicants with a family-like environmentProvides financial support based on the total amount of support and services that the applicant qualifies for |

| Independent Living Support (ILS) Program | Designed to create a flexible and dynamic delivery approach that integrates a participant’s strengths, individual and social resources, as well as approved ILS service operators to encourage independence, security, self-reliance, and social inclusion | Assists qualifying candidates to optimize their autonomy in their ordinary technical tasks, like laundry, meal preparation, transportation, taking part in communal activities, etc. |

| Direct Family Support for Children (DFSC) and Enhanced Family Support Program for Children (EFSC) | Offers financial aid for buying respite services to let family caregivers take regular breaks.Offers funds to enable families to care for their disabled child at home | Financial aid ranging from $100 - $800 per month |

| Direct Family Support for Children (DFSC) and Enhanced Family Support Program for Children (EFSC) | Offers financial aid for buying respite services to let family caregivers take regular breaks.Offers funds to enable families to care for their disabled child at home | Financial aid ranging from $100 - $800 per month |

| Flex Program | Designed to offer customized funding for eligible applicants who live at home with their families or those who live independently through the help of their families or individual support networks | Funding of up to $2200 per month |

| Wheelchair Recycling Program | Caters to the needs of children needing a wheelchair for the first time or who have overgrown their present one | Provides wheelchairs for disabled children |

Employment Support and Income Assistance (ESIA)

When you cannot support yourself or your family, the Employment Support and Income Assistance (ESIA) program can help by providing funds for living expenses or other types of assistance. When you do not have any other choices, you might turn to the ESIA Program.

The Employment Assistance and Income Assistance (ESIA) program consists of two other programs. These include:

- Income Assistance (IA): caters to persons in financial need with necessities including rent, food, clothes, and utilities such as electricity and heat.

- Employment Support Services (ESS): aims to help those on IA become more self-reliant

Eligibility

To apply for this program, applicants must:

- Be residents of Nova Scotia

- Be in financial need to pay for basic living necessities

- Be over 19 years old or 16- 18 years in some instances

- Unless you are unable to do so currently, you have attempted to acquire a job or some other means of income

Note that you have to be a beneficiary of the Income Assistance Program to qualify for Employment Support Services.

Benefits

Under the Income Assistance (IA) program, eligible applicants can receive financial assistance for basic needs via the Standard Household Rate program. The program offers applicants an allowance ranging from $686 to $1,393, depending on the number of family members and current living situation.

Eligible applicants of IA can also benefit from the Special Needs Assistance Program, which helps with:

- Child care

- Arrears

- Ambulance costs

- Emergency dental care

- Booster and car seats

- Furniture

- Extermination services, and so much more.

In addition, the program also provides a Prescription Drug Coverage (Pharmacare) program to help with expenses related to prescribed medications and devices.

When it comes to the Employment Support Services (ESS) programs, the staff will assist you in exploring the numerous programs and services available to assist you in finding new employment prospects. However, it would help if you were willing to participate in an employability evaluation and create an action plan to help you gain the experience and skills you require to get a job. When you are ready to participate in an employability test, you and your caseworker will decide what best suits you.

Take note that this evaluation examines all of your talents and experience to determine what type of work you can accomplish, what training you may require, and whether you have any hurdles to employment.

Application

To apply for the Income Assistance program, you can dial the toll-free number 1-877-424-1177, which is now accessible during extended hours. Eligible applicants can also walk into a Community Services office and phone the toll-free intake line there, available from 8:30 a.m. to 4:30 p.m., Monday through Friday.

Upon contacting the caseworker, vocalize that you want to apply for the Income Assistance program, and they will question you on your circumstances. During the call, you will need your income tax assessment forms, a copy of your lease, utility bills, bank account statements, and any other documents that will assist the caseworker to understand your current circumstances.

Once the caseworker gets adequate information about you and your family, it will take three to seven days to determine whether you qualify for the benefits program. Whether or not you are eligible, the caseworker will call you or send you a letter explaining the reasons behind the decision.

Nova Scotia Child Benefit (NSCB)

Wholly funded by the Provincial Government of Nova Scotia, the Nova Scotia Child Benefit program is a tax-free financial assistance program that offers monthly funds to assist low- and moderate-income families with the costs of bringing up children below the age of 18 years. Paired with the Canada Child Benefit (CCB) program, these sums create one monthly payment that consists of:

- $77.08/month on the first dependent under the age of 18 years

- $68.75/month on the second dependent below 18 years

- $75.00/month on any extra dependent under 18 years

You may be eligible for a portion of the benefit if you have an adjusted household net income ranging from $26,000 to $34,000. Likewise, there is no application procedure required for this program. Once you file your income tax return, the Canada Revenue Agency will determine who is eligible and who is not. Take note that there may be a delay for payments for newly qualifying families, as well as retroactive corrections for individuals who submit their income tax returns after the federal deadline.

Nova Scotia Affordable Living Tax Credit (NSALTC)

This is a quarterly non-taxable benefit designed to help low- and moderate-income people and families ease costs and create a more cost-efficient life. It aims to help these people and their families by offsetting the Harmonized Sales Tax (HST) rise and providing additional income.

NSALTC offers a maximum yearly credit of $255.00 for individuals or a couple, and $60.00 for every minor, from July 2021 to June 2022. It decreases by 5% of household net income of more than $30,000.

In addition, the credit pairs with the GST/HST credit from the federal government. The GST/HST credit and the NSALTC, which the provincial Government of Nova Scotia fully funds, do not require an official application. The CRA uses your personal income tax return information to assess eligibility for this credit.

Heating Assistance and Rebate Program (HARP)

Over 42,000 low-income Nova Scotians benefit from the Heating Assistance Rebate Program (HARP), which assists them in catering to the high expense of heating their households during winter. Eligible applicants can receive up to $200, and applications are open till March 31, 2022. The amount received depends on your 2020 individual net income reported by the Canada Revenue Agency.

Eligibility

To qualify for the rebate program, you must:

- reside alone without any children or dependents and have a net income of at least $29,000

- possess a combined net income of at least $44,000 or less and live with other adults, children, or dependents,

- get Income Assistance benefits from the Department of Community Services

- receive Service Canada’s Allowance or the Guaranteed Income Supplement (GIS)

You may still be eligible if your financial or personal circumstances have adjusted since last year. Examples of such adjustments include being widowed, losing your job, being divorced or legally separated, turning 18, newly arriving in Canada, or getting custody of your children. To see if you qualify, contact the Department of Service Nova Scotia and Internal Services for more information.

Application

Below are the steps to follow to apply for the Heating Assistance and Rebate Program.

- Complete an online application with accurate details and attach the required documents

- Submit your completed application as well as the relevant supporting documentation

- Check the progress of your application online (in the case of an online application)

- If you get a direct deposit of your tax refund, you will also get a direct transfer of your heating assistance rebate. Otherwise, the program will mail the rebate to you

Your rebate should arrive in eight weeks, but it may take longer if further information is required or if the filing of your application is incomplete. The staff may contact you through email if further information is required to fulfill your rebate.

Conclusion

An essential aspect of life and the basic unit of the community is the family. The federal government of Canada, the Government of Nova Scotia, and several non-governmental organizations provide financial aid to disadvantaged families so they may stay together and flourish. The programs discussed in this article are among the most widely available among the people of Nova Scotia. You can find more information on other government benefit programs from the government’s official webpage, and in the event that you still find your finances stretched to the limit you can rely on us for a loan in Nova Scotia to bridge the gap.