Family Benefits in Saskatchewan

More Resources

- Family Benefits in Saskatchewan

- Family Benefits in Canada

- Family Benefits in Manitoba

- Family Benefits in British Columbia

- Family Benefits in Alberta

- Family Benefits in Ontario

- Family Benefits in Nova Scotia

Table of Contents

Approximately 30% of all families in Canada report experiencing difficulty covering necessary expenses such as food, heating, and rent since the COVID-19 pandemic hit. Families in Saskatchewan are not immune to the ongoing financial hardships.

Fortunately, the Saskatchewan Provincial Government offers many family welfare and benefit programs. To help Saskatchewan residents through these difficult times, we have provided this comprehensive guide to the available family benefits programs in Saskatchewan and how to utilize them.

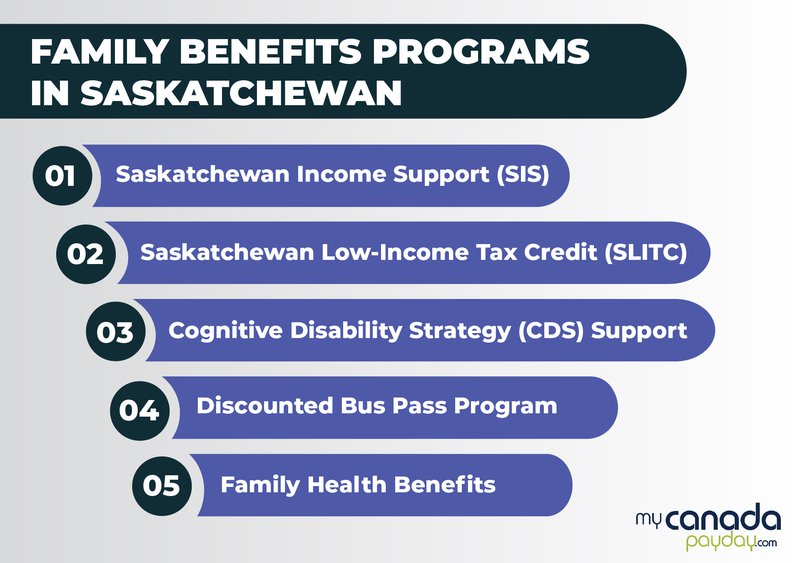

Family Benefits Programs in Saskatchewan

The Saskatchewan Provincial Government has a robust financial assistance program for various disadvantaged individuals and groups. These groups include families experiencing financial challenges, including families with or without kids. Notably, families and individuals within the family unit can qualify for several of these welfare programs.

Here is an overview of five of the biggest and most popular family welfare and benefits programs in Saskatchewan:

- Saskatchewan Income Support (SIS): designed for families facing financial hardships because of unemployment or low income.

- Saskatchewan Low-Income Tax Credit (SLITC): also designed for families facing financial hardships because of unemployment and low income.

- Cognitive Disability Strategy (CDS) Support: designed for families with members experiencing extreme developmental and behavioural challenges.

- Discounted Bus Pass Program: designed to offer families generating low incomes affordable access to public transportation services.

- Family Health Benefits: designed to offer low-income families affordable access to healthcare services.

You can learn more about each of these benefits by clicking on the links listed above. Here is a more detailed overview of two of the easiest programs to access among these: Saskatchewan Income Support (SIS) and Saskatchewan Low-Income Tax Credit (SLITC).

Saskatchewan Income Support (SIS)

The Saskatchewan Income Support (SIS) program offers financial aid to the unemployed and those earning low incomes. It is worth noting that this program is available to everyone, including individuals and families.

The amount of financial aid you can get via the SIS program ultimately depends on your employment status: whether or not you are employed and how much you make. Other factors that affect the amount available to you include:

- Familial status – whether you are single or married with or without kids.

- Accommodation status – where you live and how much you pay in rent and other related expenses.

- Location – whether or not you live in a remote northern community (living in the remote north automatically qualifies you for more financial aid).

The SIS program offers dozens of benefits to qualifying applicants. Here is a brief overview of each benefit and what it entails:

| Type of Benefit | Purposes | Amount |

|---|---|---|

| Children's Benefit |

· To cater for expenses such as food and clothing. · Available to parents who are not eligible for the Canada Child Benefit program. $400/month |

$400/month |

| Childcare Benefit |

· Available only on a short-term basis. · The applicant must be actively seeking employment or going to job interviews. |

$30/day |

| Shelter | To pay for shelter-related costs, including rent, mortgage, and utilities. |

· $575/month for singles in Regina ($525 outside Regina). · $750/month for couples without dependent children in Regina ($650 outside Regina). · $975/month for families with one or two dependent children in Regina ($750 outside Regina). · $1,150 for families with three or more dependent children in Regina ($850 outside Regina). |

| Household Health & Safety |

· To set up a new residence after a disaster or because of interpersonal violence. · To replace household items lost or damaged after a disaster or case of interpersonal violence. |

A single payment of up to $500. |

| Stabilization | Available for people who cannot maintain stable housing. | $150/month. |

| Short-Term Emergency Assistance | Emergency (unforeseen) situations that would likely result in harm if the payment wasn’t made. | Varies depending on the situation. |

| Travel Benefit |

· To cover transport costs when travelling outside the community for job interviews. · Can also cover the cost of food, shelter, and other related expenses. |

Varies depending on the situation. |

| Alternate Heating Benefit | To buy alternative heating solutions for households without access to natural gas. | $130/month. |

| Prescribed Diet Benefit | To purchase food for people with medical conditions that require special diets. | $50 - $150 per month. |

| Employment & Training Benefit | To cover the costs of enrolling into a new training program or starting a new career. | $140/month. |

| Relocation Benefit |

To help cover relocation and moving costs due to factors such as: · Evictions for reasons beyond your control. · Starting a job outside the community. · Health and other uncontrollable emergencies. · Finding a more affordable or secure place to live. |

$200 - $300 depending on your household’s size and the moving distance. |

| Security Deposit | For up-front funds required to rent a home | Can equal the amount available in shelter benefits. |

| Funeral Benefits | To cover funeral expenses for a family member | The amount varies depending on the situation. |

Saskatchewan Low-Income Tax Credit (SLITC)

The Saskatchewan low-income tax credit (SLITC) is administered by the Canada Revenue Agency on behalf of the Saskatchewan Provincial Government. It is tax-free financial aid available to residents making low-to-modest incomes. Here is an overview of the amounts available for the 2021-2022 period:

- $349 per month for an individual.

- $349 per month for a partner or spouse.

- $137 per month per child (limited to two children per household).

As such, the maximum total amount that one household with two kids can receive is $972 per month. The amount of money available in aid ultimately depends on the household’s income. On that note, households that make less than $32,986 per month are eligible for full benefits, while those making between $32,986 and $68,330 are eligible for partial benefits. It is also worth noting that these payments are also combined with the quarterly federal GST credit payments.

Cognitive Disability Strategy (CDS) Support

The Cognitive Disability Strategy (CDS) Support is meant to provide healthcare and financial assistance to people living with various disabilities. The benefits are accessible to the disabled beneficiaries and their families.

Benefits

The healthcare benefits derived from the CDS program entail free and affordable access to professional cognitive disability consultants. These consultants can diagnose the person living with a disability and recommend efficient behavioural support plans.

On the other hand, the financial benefits derived from the CDS program entail financial assistance to help isabled individuals and their families pay for unmet needs. The amount of money available in financial assistance depends on factors such as the family’s gross income and the condition’s severity.

Eligibility

The CDS program is available only to people living with a disability. As such, applicants must prove that they are suffering from a diagnosable disability, whether mental or physical. The disability must also be long-term, except in cases of acquired brain injuries.

Applicants must also prove that they have an unmet need that they can solve with some financial assistance. The individual and their family may also be required to provide documents such as their pay stubs because the financial assistance is income-tested.

Application

Qualifying applicants can apply for CDS benefits by downloading and filling the program’s application form and sending it to a cognitive disability consultant. Family members can also complete and submit these forms on behalf of the applicant.

Discounted Bus Pass Program

Many studies show that the financially disadvantaged people in society mostly use public transport to get to work. The Discounted Buss Pass Program offers beneficiaries affordable access to the city’s public transport system. The goal is to help beneficiaries get to work and make a living, hopefully lifting them out of their current financial positions.

This program offers beneficiaries discounted bus rides on limited range of municipal buses. Eligible applicants must also meet the requirements set for the following benefits programs:

- Saskatchewan Income Support (SIS)

- Saskatchewan Employment Supplement (SES)

- Saskatchewan Assured Income for Disability Program (SAID)

- Provincial Training Allowance (PTA)

Qualifying applicants can purchase discounted bus passes at their local public transit office. Applicants will be required to show proof that they are beneficiaries of one or more of the benefits programs listed above.

Family Health Benefits

Low-income families in Saskatchewan are also eligible for a range of health benefits. Eligible families must be beneficiaries of the Saskatchewan Employment Supplement (SES) and must pass the set standards for an income test.

The available family health benefits vary between children and parents. The parents are eligible for $100 semi-annual deductible drug coverage and 35% consumer co-payments. They are also eligible for one eye examination every two years. Children are eligible for the following medical benefits:

- Dental services.

- Annual eye examinations.

- Prescription drugs.

- Emergency ambulance service.

- Basic medical supplies.

All beneficiaries will be required to present their Saskatchewan Health Services card whenever they access healthcare services for the benefits to be applied. It is also worth noting that parents and legal guardians can also apply for more coverage via the Special Support Program.

How to Apply for Family Benefits in Saskatchewan

The process of applying for family benefits varies depending on factors such as the benefits program and the type of benefits. As mentioned, you can click on each of the programs’ links to go to their official platforms where you can learn everything about them, including how the application process works. Here is a general overview of the various programs’ application requirements and channels.

Application Requirements

Most programs require applicants to provide the following documents and details:

- Your Saskatchewan Health Services Number (HSN).

- An accurate, completed Direct Deposit Authorization form.

- Basic details about your spouse or partner, including their HSN.

- Basic details about your children.

- Details about your income and all finances available to you, including your investments, stocks, and money in the bank.

- Details about a bank account held in your name (it can be an individual or joint bank account).

- Details about your possessions, including large assets such as cars and houses.

- Documents that can be used to verify your living situation, such as a rental agreement.

- Details about all other benefits available to you.

It is worth noting that you have only 30 days since the date of posting your application to provide these and any other required details and documents. It is important to provide all the requested details and documents and ensure that they are accurate to avoid disqualification.

Application Methods

Different family benefits programs offer several methods through which beneficiaries can send their applications.

Applying Via Mail

Submitting your application via mail involves downloading the program form, printing it out as a hardcopy, and mailing it to its respective program. The form should be filled correctly for easier and faster processing. It is worth noting applications made via mail may take several days or weeks longer to process compared to applications made online.

Applying Online

Every family benefits program in Canada has a fully functional website via which users can do everything, including making their applications. To this end, the list of family benefits programs above features corresponding links to each program.

The online application process varies from one benefits program to another. However, most online applications have several things in common, including:

- Creating an account – you will need to register an account under your name using your personal details for the program to recognize you.

- Filling in the application form – the program will require you to provide details about yourself, your family, and your situation through one or several application forms.

- Submitting your form – many programs will not accept your application if it isn’t complete.

Many programs will also let you monitor and track your application’s progress. It is important to securely store your login credentials as you will need them to access your online accounts in the future.

Eligibility for Qualifying for Family Benefits in Saskatchewan

You and your family may be eligible for family benefits in Saskatchewan if you meet the following requirements:

- You must be a Canadian citizen or a permanent resident (refugees must have legal refugee status).

- You must be a resident of Saskatchewan.

- You must be at least 18 years old.

- You must be unemployed or working a low-income job.

All programs also advise their beneficiaries to exhaust all other avenues before making their applications. However, you can also get benefits from multiple programs simultaneously (but you must indicate it on your application form).

Conclusion

Family is the most important thing in life. The Canadian federal government, Saskatchewan provincial government, and several non-governmental organizations offer vulnerable families the financial assistance they need to stick and grow together. The programs covered in this article are among some of the most accessible ones. You can find a comprehensive range of resources on family benefits on the government’s official portal, and when these resources aren't sufficient you can still turn to loans in Saskatchewan with My Canada Payday. We offer loans of up to $1,500 and income derived from benefit programs like CPP is eligible.